Bridging to $SEI

Introduction The blockchain ecosystem is highly decentralized, with numerous networks, each having unique benefits. Sei Network is a highly optimized Layer-1 blockchain designed for trading and decentralized finance (DeFi). However, with assets spread across different networks, users need tools to transfer tokens from one chain to another efficiently. This is where bridging comes into play.

Bridging is the process of transferring tokens or assets from one blockchain to another. It involves moving tokens across chains without them leaving their original blockchain. Instead, a corresponding representation of the token (e.g., wrapped tokens) is created on the destination chain.

Why Bridge to Sei? Sei offers: -Optimized Trading: Sei’s architecture is built to support high-speed and efficient trading applications, with features like Twin-Turbo Consensus and frequent batch auctions. - Decentralization and Security: As a Cosmos SDK-based network, Sei offers native interoperability with other Cosmos chains, allowing users to bridge assets seamlessly. - Growing DeFi Ecosystem: Sei’s native decentralized applications (dApps) allow for staking, swapping, and decentralized trading, attracting traders and liquidity providers to the network.

The Bridging Process Bridging assets to Sei typically involves transferring tokens from a popular Layer-1 blockchain like Ethereum or Binance Smart Chain to the Sei network. Let’s explore the steps and tools involved in the process.

Step-by-Step Bridging Process

Selecting a Bridge Provider Several bridging protocols and dApps allow users to bridge their tokens to Sei. The most popular options include:

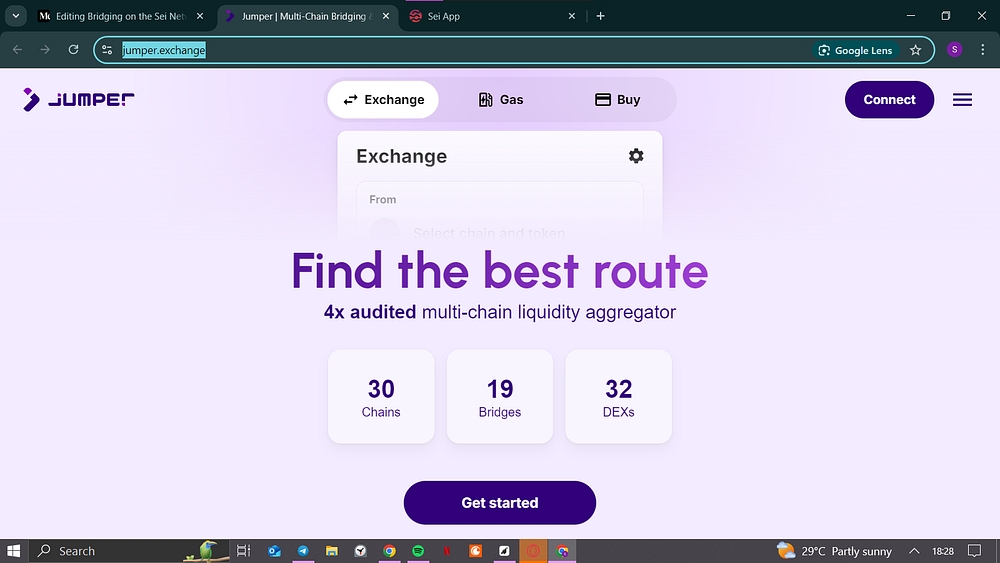

a) Jumper Exchange: a cross-chain liquidity aggregator that simplifies asset transfers between blockchains, ensuring low fees and optimal rates for users. it supports major networks like Ethereum, BNB Chain, Avalanche, and thus allow easy bridging of assets via many chain to Sei, making cross-chain swaps easy and efficient.

b) Squid: Squid, powered by Axelar, is a cross-chain liquidity protocol that allows users to swap and transfer tokens across various blockchains like Ethereum, Binance Smart Chain, and Polygon. It simplifies asset movement by bridging tokens like USDC between networks, reducing slippage and gas costs. Squid enhances DeFi interoperability, making it easier to manage assets across multiple platforms.

c) Symbiosis:

These protocols handle the movement of tokens from one network to Sei by either locking tokens on the original chain and minting an equivalent wrapped token on Sei or facilitating direct transfers if the token exists natively on both chains.

2. Connecting Your Wallet Before initiating the bridge, you must: — Connect a wallet like MetaMask to the source chain where your assets currently reside. — On the Sei app or the bridge dApp, connect your Sei wallet to the destination chain to receive the bridged assets.

3. Choosing Tokens and Networks In the Sei Bridge Interface, you’ll: — Select your source chain (e.g., Ethereum). — Choose Sei as your destination chain. — Select the token you wish to bridge, such as USDT, ETH or USDC.

4. Executing the Bridge After selecting the token and chain: — Click on Find Bridge Providers, which will show you the best available bridge options like Jumper, Symbiosis or Skip. — Choose the provider, and you’ll be redirected to their platform to finalize the transfer. — Review the transaction details carefully, ensuring that your wallet address is correct.

Once confirmed, the bridge will lock or burn the token on the source chain and mint the equivalent token on the Sei network.

5. Receiving Tokens on Sei After a successful bridge transaction: — Your wallet on Sei will reflect the transferred token, such as USDT (Sei-native) or a wrapped version of the original token. — You will be able to use the bridged tokens for DeFi activities on Sei, such as staking, liquidity providing, or trading.

Example of Bridging with Jumper Jumper simplifies cross-chain swaps and bridging.

Here’s how to use Jumper to bridge from Ethereum to Sei: 1. Go to Jumper Exchange 2. Select Ethereum and Sei: Choose Ethereum as the source chain and Sei as the destination chain. 3. Choose the Token: Select the token you wish to bridge, e.g., USDT. 4. Connect your Wallets: Ensure both your MetaMask (for Ethereum) and your Sei wallet are connected. 5. Review and Sign: Once you’ve selected your bridge route, review the fees and transaction details, then sign the transaction. 6. Completion: After processing, you’ll have USDT (Sei-native) in your Sei wallet.

What to Expect After Bridging Once your assets are bridged to the Sei network: — You will see the native or wrapped version of the token in your Sei wallet (e.g., USDT-ERC20 as USDT-Sei). — Gas fees: Ensure you have Sei (SEI) tokens in your wallet for gas fees when interacting with dApps or transferring tokens. — You can now use the Sei network’s decentralized applications to swap, stake, or provide liquidity using the bridged tokens.

Benefits of Bridging to Sei 1. Interoperability: Seamlessly connect with other Cosmos-based chains and Ethereum via bridges like Celer and Axelar. 2. Cost-Efficiency: Sei’s consensus mechanism ensures low latency and reduced gas fees, making transactions faster and more affordable. 3. Enhanced Trading Experience: Sei’s infrastructure is tailored for DeFi, offering deep liquidity and efficient order execution.

Risks and Considerations 1. Slippage and Fees: While bridges aggregate liquidity, token price fluctuations or network congestion could lead to higher slippage or gas fees. 2. Security: While the protocols are secure, cross-chain bridges are often a target for hackers. Only use audited and trusted bridge providers. 3. Native Tokens: Always confirm whether the bridged token is a wrapped version or native to avoid confusion during swaps or liquidity provision.

Conclusion Bridging assets onto Sei is a crucial part of interacting with its growing DeFi ecosystem. By using trusted bridge providers such as Jumper Exchange (Do your research), users can transfer their tokens from other blockchains like Ethereum onto Sei efficiently and securely. This enhances the possibilities for traders, liquidity providers, and developers to benefit from Sei’s optimized infrastructure.

Last updated